Auto depreciation calculator for taxes

See how this would be allocated on your taxes in the table below. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

Mileage Log Template For Taxes Luxury Vehicle Mileage Log James Orr Real Estate Services Door Hanger Template Templates Custom Door Hangers

Value of the Car when Purchased x Days you owned 365 x 200 Effective life in.

. A car depreciation calculator is a handy tool that helps estimate a cars value after being used for a given amount of time. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. So 11400 5 2280 annually.

Cost x Days held 365 x 100 Effective life in years Note also that where motor vehicles are concerned luxury cars have an upper depreciation limit. By entering a few details such as price vehicle age and usage and time of your ownership we use our depreciation models to estimate the future value of the car. Eligible vehicles include cars station wagons and sport utility vehicles.

Prime Cost Depreciation Method The Prime Cost method allocates the costs evenly over the years of ownership. Our Car Depreciation Calculatorbelow will allow you to see the expected resale value of over 300 modelsfor the next decade. There is a dollar-for-dollar phase out for.

Consult a tax professional before purchasing a vehicle for business use to determine. It is included here so that when you print a schedule it will include the identity of the asset. Car age current time expected to use in years A CCA TET.

Section 179 deduction dollar limits. The following calculator is for depreciation calculation in accounting. The algorithm behind this car depreciation calculator applies the formulas given below.

Under this method the calculation of depreciation is based on the fixed percentage of its cost. If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000. We have also built historical depreciation curves for over 200 models many of which go back as far as 12 years.

The calculator makes this calculation of course Asset Being Depreciated - This has no impact on the calculation. Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the. Work-related car expenses calculator.

It takes the straight line declining balance or sum of the year digits method. But for the next year your wdv will be considered as reduced by the percentage of depreciation prescribed. 1 lakh and 80 depreciation is prescribed for the asset and you charge only rs.

Depreciation Calculator Definition Formula For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. The MACRS Depreciation Calculator uses the following basic formula. Before you use this calculator.

30000 8 2400. Depreciation can be claimed at lower rate as per income tax act. Use this depreciation calculator to forecast the value loss for a new or used car.

In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 18100 of the purchase price of Nissan models that dont qualify for the 100 depreciation deduction when purchased and placed in service in 2021. Using the values from the example above if the new car was purchased in a state without a sales tax reduction for trade-ins the sales tax would be. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles.

For eg if an asset is of Rs. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning. If you are using the double declining balance method just select declining balance and set the depreciation factor to be 2.

Diminishing Value Method for Calculating Car Depreciation. The basis is multiplied by our business-use percentage to determine the depreciable basis of the vehicle for tax purposes. You can always use this calculator to determine how much your vehicle is currently worth or verify whether the price you were offered for your used car was fair or not.

We will even custom tailor the results based upon just a few of your inputs. Non-ACRS Rules Introduces Basic Concepts of Depreciation. In the example shown above the depreciable basis on our 20000 vehicle would be 11400.

It can be used for the 201314 to 202122 income years. This Auto Loan Calculator automatically adjusts the method used to calculate sales tax involving Trade-in Value based on the state provided. 30000 as depreciation in this case next year wdv will be.

Rick Mony October 14 2021 3 min read. Cost of Running the Car x Days you owned 365 x 100 Effective life in years Lost Value. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation rate for year i depends on the assets cost recovery period.

- Total car depreciation for the time it is used C sum of the depreciation year per year for the given TET considering that the annual depreciation for year n is 1075 from the. Qualifying businesses may deduct a significant portion up to 1080000 in 2022 to be adjusted for inflation in future years. Our estimates are based on the first 3 years depreciation forecast.

Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures.

5 Tips For Buying A Car The Smart Way Car Buying Car Buy Used Cars

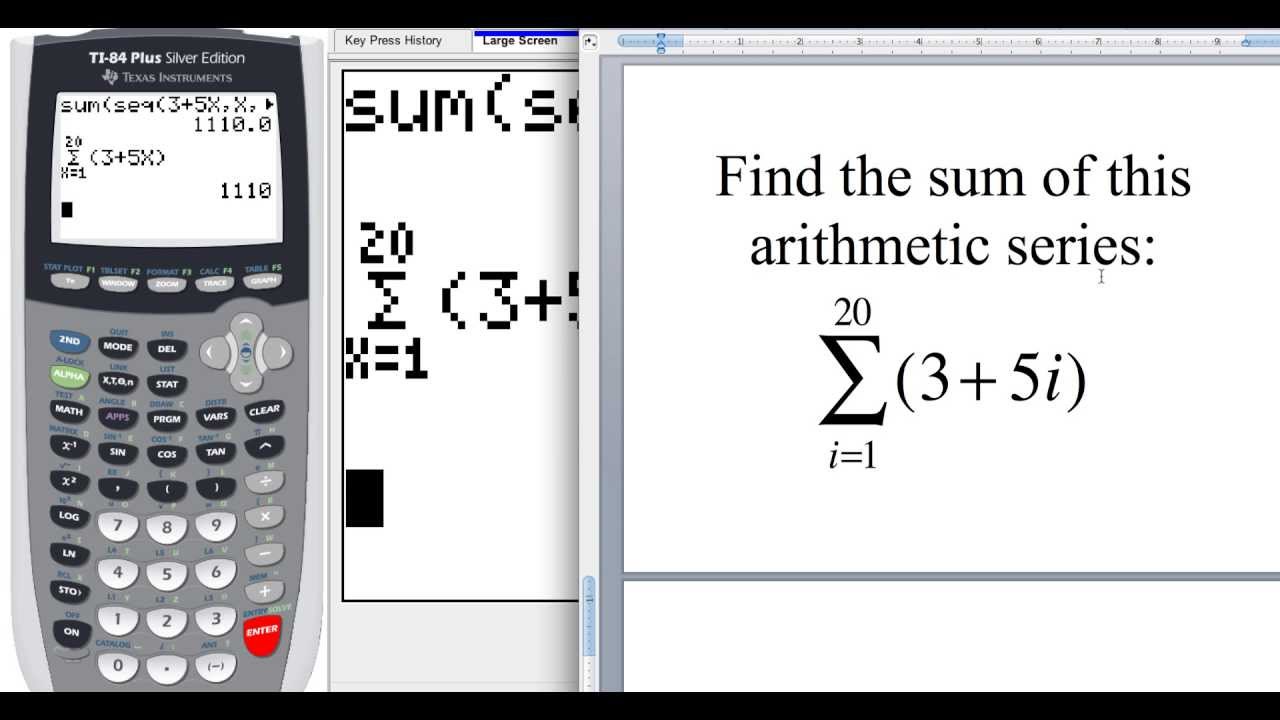

12 2 How To Find The Sum Of An Arithmetic Sequence On The Ti 84 Precalculus Graphing Calculators Arithmetic

Accountantteams I Will Do Bookkeeping In Quickbooks Online And Xero Accounting For 10 On Fiverr Com Bookkeeping Services Bookkeeping Credit Score

Projected Profit And Loss Account In Excel Format Profit And Loss Statement Statement Template Spreadsheet Template

Airbnb Property Analyzer Income Property Investment Etsy In 2022 Investing Income Property Investment Property

Pin Em Cost Of Goods

Pros And Cons Paying Your Mortgage Off Early Part 3 Hold Up There Are A Credit Card Che Mortgage Payment Calculator Mortgage Payment Credit Cards Debt

Afinoz Mortgage Loans Business Loans Best Mortgage Lenders

How To Make Maximum Profit In Your Self Storage Business Self Storage Small Apartment Storage Solutions Small Apartment Storage

If You Want To Purchase The Best Accounting Software You Need To Look Into The Size Of Your Business And Search For A Business Loans Blogging Basics Financial

Projected Income Statement Template Lovely Financial Statements Excel Template Projected In E Statement Template Income Statement Mission Statement Template

Five Star Luxury Limo Service Inc Limousine Black Car Service

Can You Gift A House To Your Children For 1 Sales Tax Filing Taxes Tax Return

Real Estate Lead Tracking Spreadsheet Tax Deductions Free Business Card Templates Music Business Cards

Projected Income Statement Template New Projected In E Statement Template Free Amazing Design Statement Template Mission Statement Template Income Statement

Airbnb Property Analyzer Income Property Investment Etsy In 2022 Investing Income Property Investment Property

Cash Flow Projection Template Flow Chart Template Cash Flow Cash Flow Statement